Trading on the news

Fundamental factors have no less impact on the market than technical ones. Often, the release of important economic and political news is accompanied by so sharp jumps in value that at one point hundreds of thousands of Forex transactions are closed by stop loss. With this, you can both lose money and make good money if you prepare properly.

A news trading strategy involves making a decision on the eve of a key news release. The market reacts to any information very quickly, therefore there is a separate direction of trading robots, which in comparison with a person win in speed of decision-making.

How news affects the market

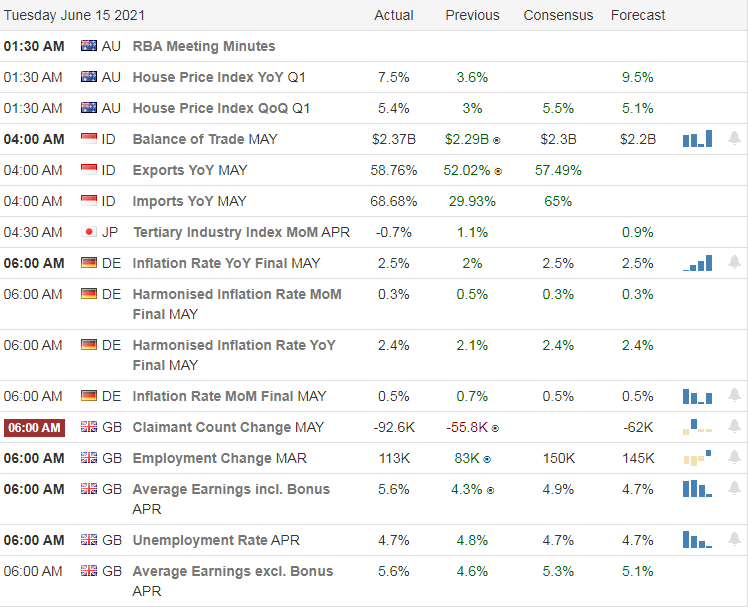

A significant impact on the exchange rate is provided only by important news. In the Economic calendar of the trader, they are marked with a special sign in the form of 2 or 3 goals of the bull. If you look at a chart of any currency, then it is easy to detect sharp jumps in a course over a short period of time. In most cases, such situations are determined by the release of key news.

For clarity, consider an illustrative example. On July 20, the EUR / USD rate for 2 hours rose by 165 points. Such high volatility was due to a press conference with the participation of the head of the ECB. At the event, positive news was voiced, which led to the strengthening of the European currency.

Almost every performance by Mario Draghi is accompanied by a sharp change in the volatility of the euro. Therefore, many traders who prefer technical analysis do not trade while they wait for news to be released and some time after.

To conduct successful trading, relying on the news, the trader must have extensive experience. Therefore, beginners are not recommended to use this strategy. However, any Forex trader must follow the news, as this will prevent unplanned losses. For this purpose, a special tool was created the Economic Calendar. It shows a list of all the events that affect the volatility of currencies.

Another advantage is the availability of a forecast for some news. In most cases, they come true, so even novice traders can focus on these signals. However, for most events, no forecasts are given in the Economic Calendar.

Rumors and facts

Economic news is beginning to influence the market even before it comes out. Waiting for an event sometimes leads to an even greater change in volatility than the actual reaction. A popular principle works here, which sounds as follows "buy rumors, sell facts."

Rumors are information about an expected event. Often, data comes from unverified and doubtful sources, or vice versa, there is a leak of insider information. All these factors often lead to general excitement among exchange players.

A small percentage of traders with hidden insider information enter the market before the event. The remaining mass of merchants also begins to act, based on various rumors. In the aggregate, it turns out that the currency volatility begins to grow in advance only on expectations alone.

By the time the news is released, the most experienced traders are already leaving the market, having received their profit. They received the necessary insider information at the very beginning of the trend, caused by expectations about the upcoming event. From this moment begins the biggest fluctuations. About 95% of traders open transactions after the publication of news. General chaos begins in the market. The results can be unpredictable both a sharp drop in the rate and growth.

How to trade news

As a rule, after the release of important news on the market, volatility rises sharply, either a sharp rise in prices or a drop is observed. There is a strategy called Streddle, which allows the trader to make a profit in any case, regardless of whether there is positive news or not. Its essence is to place two pending orders immediately before the news release.

As soon as a strong rise or fall in quotes, one and deals will automatically open. Important news leads to price fluctuations of 50-100 or more points. Given this fact, pending orders should be placed at a distance of approximately 10-15 points from the original price immediately before the expected event.

There is another strategy suitable for post-news trading, when the market is already starting to stabilize after a sharp increase in volatility. It is based on the patterns of price rollback. After a sharp increase (or fall), prices are almost always slightly adjusted in the opposite direction.

Entrance to the market should be carried out at the moment when the main movement began to slow down. Trend indicators in such situations indicate oversold or overbought. This usually happens about an hour after the news release. At this time, you can open a deal, waiting for a price correction.