Forex Benefits

What is forex trading? Main advantages.

A lot of gossip and rumors about the Forex currency market at the same time attract and repel its potential participants. Some draw a lot of the advantages of trading activity, while others list a bunch of terrible disadvantages. But is it worth it to perceive everything exclusively by ear, or can he take it himself and try to work? After all, those circumstances that for one are a clear advantage for the other can become a significant drawback. And someone will take advantage of the disadvantages for themselves. All people are different, and in the same situation they perform completely opposite actions under the pressure of various factors (knowledge, skills, emotional impact, psychology, etc.). That is why any auditory assessment will be absolutely relative. But nevertheless, we bring to your attention some positive features that characterize the tempting work of traders.

The main advantages of the international Forex currency market:

1. High Forex liquidity and stability.

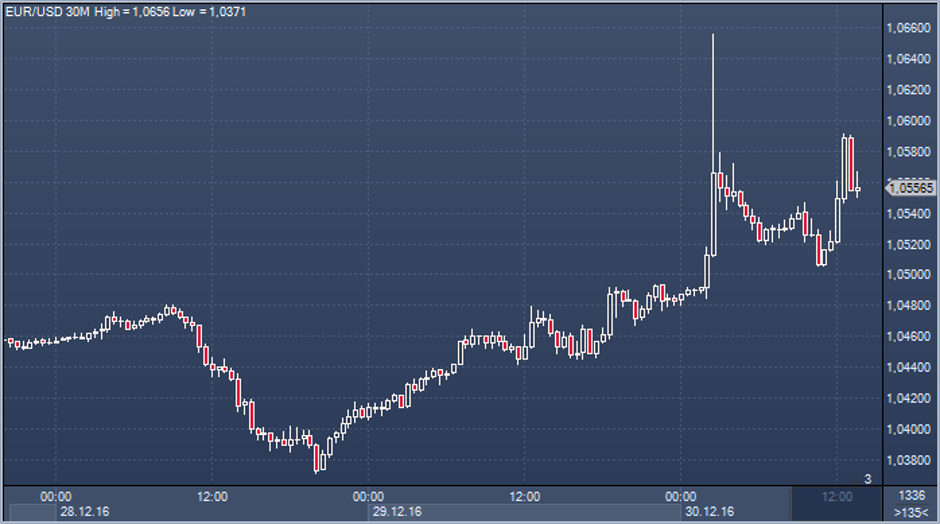

Constant demand for foreign currency, convenient trading operations, an increasing number of participants every day, a daily turnover of more than $ 4 trillion. These factors characterize the Forex currency market as the most highly liquid. His round-the-clock work is very convenient even for the laziest trader. And the unlimited size of transactions and the ability to quickly withdraw profits significantly increase its popularity. A lot of trading operations performed by market participants (commercial banks, financial institutions, currency exchanges, brokers and others), instantaneous speed of executed transactions, constant availability of sellers and buyers, affordable opening of deposits in various currencies - all these qualities prove the stability and liquidity of the Forex market .

2. Low start and easy entry.

Almost all futures and stock markets require a large account from their traders (several thousand dollars). More recently, the Forex market has made similar demands on its customers. But, with the development of computer technology and enhanced modernization, Forex has opened up new opportunities and many times increased the number of its participants. Any person interested in earning income will now be able to make trading operations. Forex trading can begin even with $ 1. And some brokers offer the best option for trading without investments (i.e., opening bonus accounts, participating in special programs, promotions and contests on demo accounts, affiliate programs, and so on.). Providing an interest-free loan (leverage) can also significantly increase the size of your deposit. For example, having only $ 100 on your account, you draw up a leverage of 1: 100, and now you can trade for $ 10,000. Moreover, without any interest and commissions. And you yourself choose the appropriate leverage size (1:10, 1: 100, 1: 500, etc.). Do not forget that a too high leverage can turn a Forex advantage into a disadvantage, because the excitement that forces a trader to increase the deposit size significantly increases the risks and can lead to serious losses. Such trouble can very well be avoided if one does not risk his capital without having certain knowledge and practical experience.

3. Unlimited possibilities:

a) Convenient time.

The round-the-clock work of Forex is created due to the fact that it is global, that is, it is an international structure consisting of trading floors located in different time zones. This is ideal for people working in other jobs. Everyone will be able to choose a currency pair that is active at a convenient time for him.

b) Free schedule and place of work.

Lack of superiors, requirements and obligations. You are completely free to choose the time for trading (morning, day, night), as you prefer. Weekends and holidays - when you wish. The length of the working day is at your discretion. No bosses!

In addition, a place for trading can also be chosen at will (you want to the sound of the sea wave or on a soft lawn, on the road, transport, etc.). The main condition is a high-quality Internet connection.

c) Self-study and lack of special education.

To become a Forex trader, it is not necessary to graduate from special universities. Of course, it is desirable to have the ability and ability to learn, as well as to have intuition, be able to think and analyze. All the necessary knowledge regarding working on Forex, you can get from the Internet. Currently, there is a huge amount of training material (articles, video tutorials, forums, etc.). Many dealership centers offer free training, seminars, and other classes that you can take without leaving your home, online.

Start trading with a virtual (demo account), study the market, learn how to analyze, gain experience and only then, slowly, move on to real trading.

d) Automatic trading.

Connecting automatic programs (advisers) with skillful use can also facilitate the work of traders. You can order a trading robot from specialists, but at the initial stages of trading it will still be wiser to conduct transactions manually or semi-automatically.

e) No additional costs.

When you open your own company, you are surely faced with a huge amount of additional costs (advertising, delivery and storage of goods, execution of contracts, permits, etc.). To work on Forex, you just need to go to the desired site, open a deposit account, replenish it, and you can start trading.

f) Lack of commission costs.

A big advantage of Forex is the lack of payment for trading, except for the spread (the difference between buying and selling currencies), which is indicated in the contract initially, and is removed when the transaction is opened.

g) A convenient platform for investment.

Various PAMM and other investment systems will help investors to invest money successfully, and traders to earn money on trust. If investors do not have the desire or ability to engage in trading themselves, they simply can transfer their capital to trust for professionals.

4. High profits in minimal time.

Extraction of a large income in a short time is almost the main advantage of the Forex market. But at the same time, this item is its most serious drawback. To avoid large losses, it is necessary to strictly control the level of risks, not overstating them and not forgetting the importance of protective orders.

The Forex market is a constantly improving financial system, full of innovations and additions. In any project, there are necessarily both advantages and disadvantages. Forex prospects are obvious. And you can easily resist its shortcomings when you learn to analyze and feel the market, improve and apply your knowledge in practice. Deficiencies are easily eradicated by deeper study, and practical experience will teach you how to turn disadvantages into advantages.

Should I be afraid of what I have not seen? Just come and see!

Russian

Russian  中文

中文  العربي

العربي  Bahasa Indonesia

Bahasa Indonesia