Stock exchange

Here I will tell you about the internal system of the exchange. How is the price formed, what are ticks, how is buying-selling going and so on. will illustrate everything with examples.

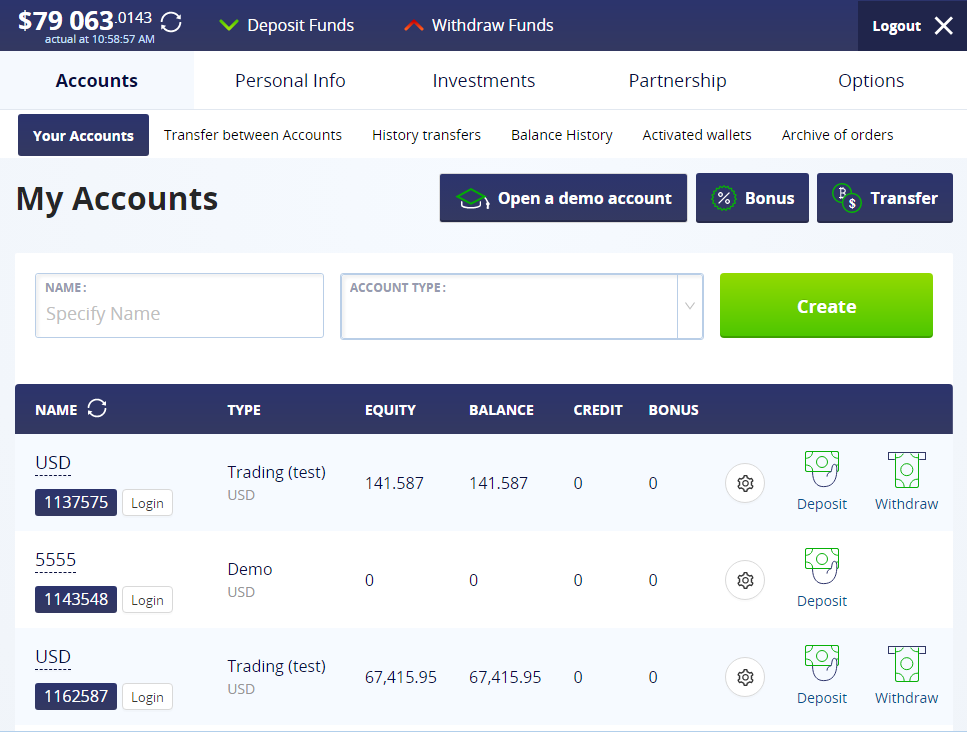

When you register on the exchange, you enter money into one of your accounts:

You can replenish your account only with the currency of the account (in dollars a dollar account, with lightcoins an account in lightcoins, etc.)

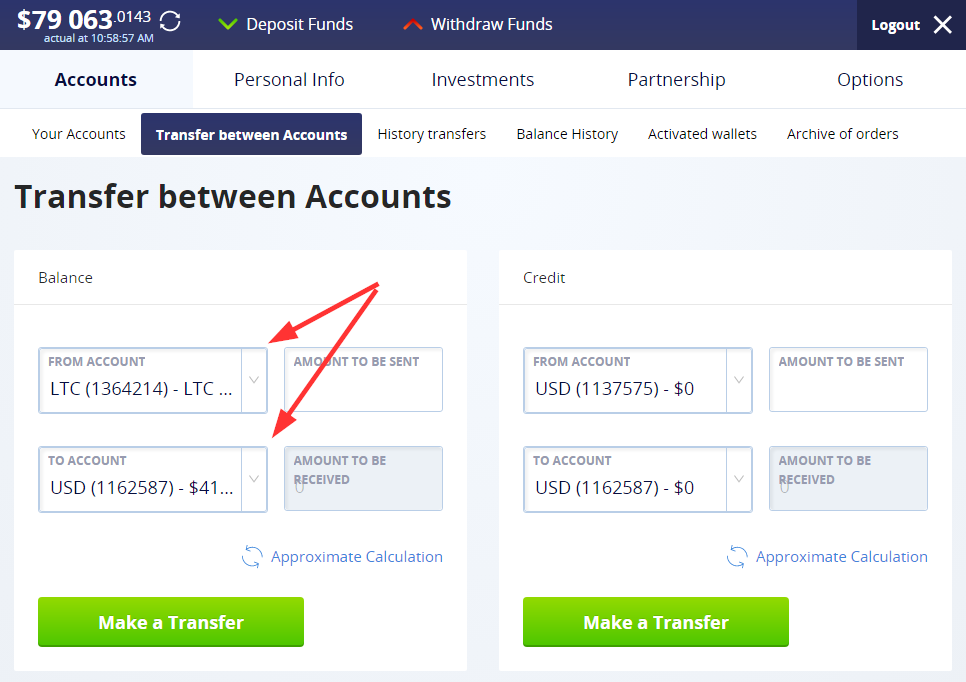

Then you can exchange one currency for another (I will tell you how the price is formed a bit later)

Suppose you replenish your lightcoin account:

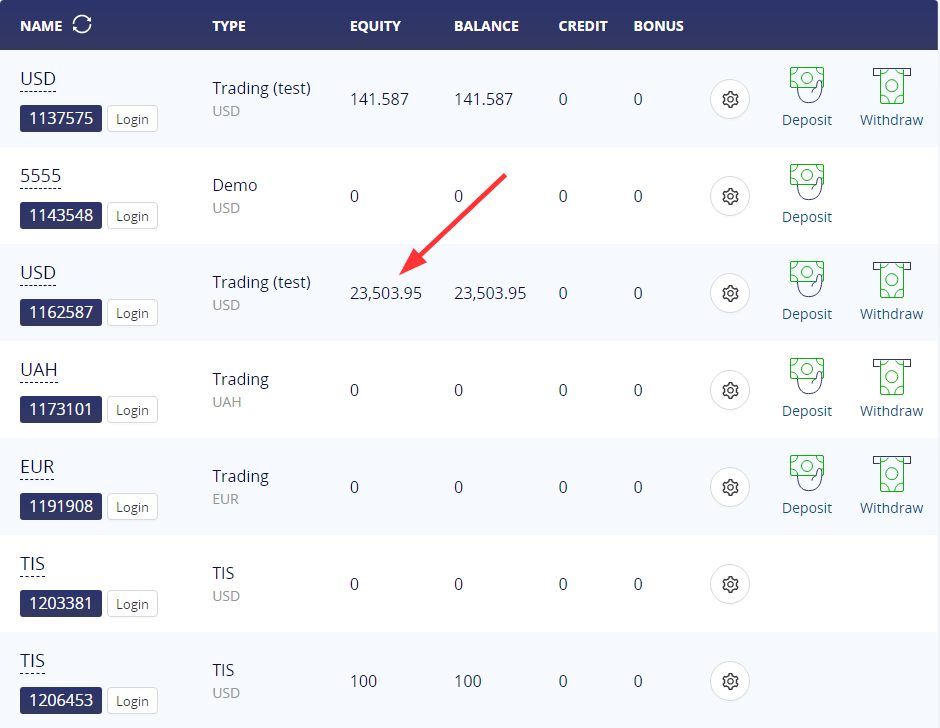

And transfer it to a dollar account

Now we have made an exchange.

How is trading on a real exchange going when we speculate with cryptocurrencies and make money on their movement.

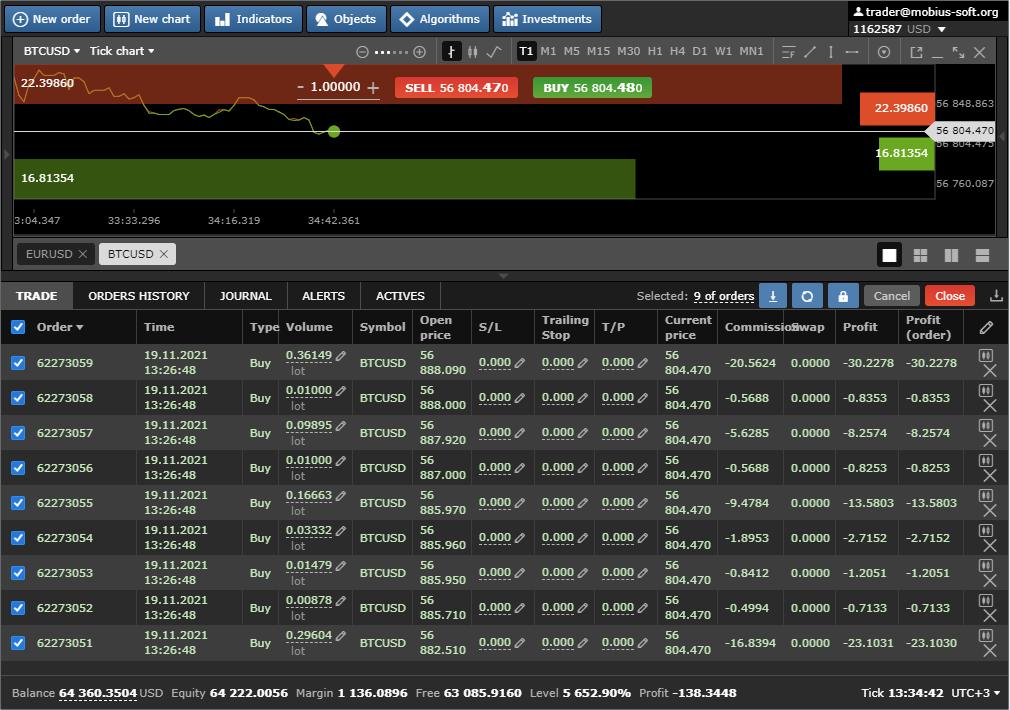

We log in our terminal

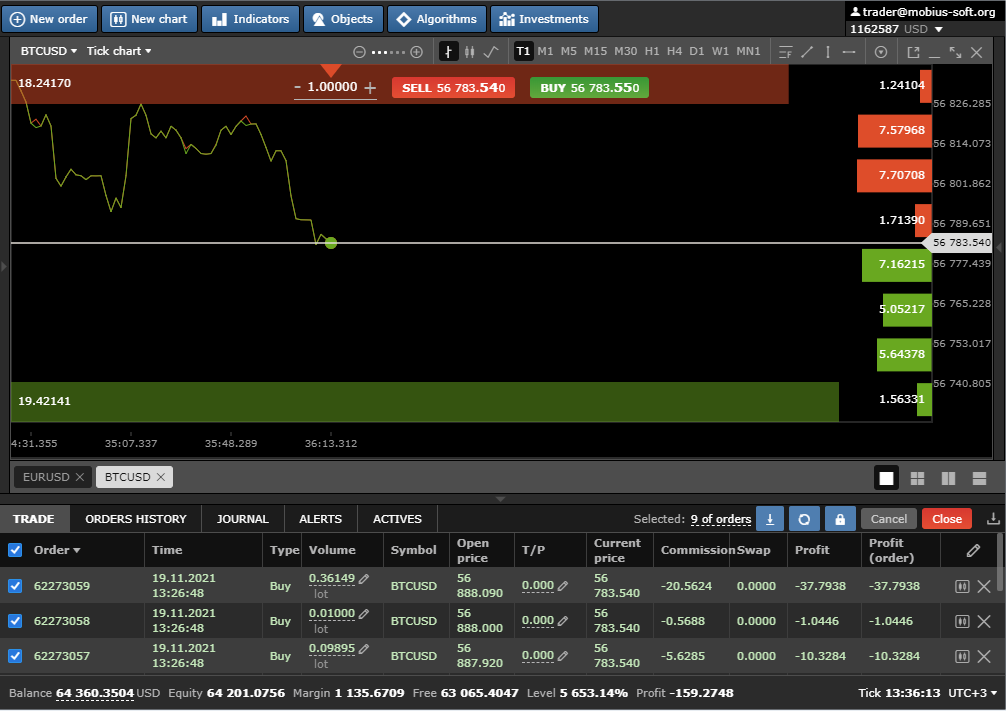

For example, you want to buy Bitcoin open the chart and buy 1 bitcoin.

Look this is the deal, the second one says that we bought one bitcoin. This is how much we spent dollars (shown as collateral). At the moment, we actually have 1 bitcoin.

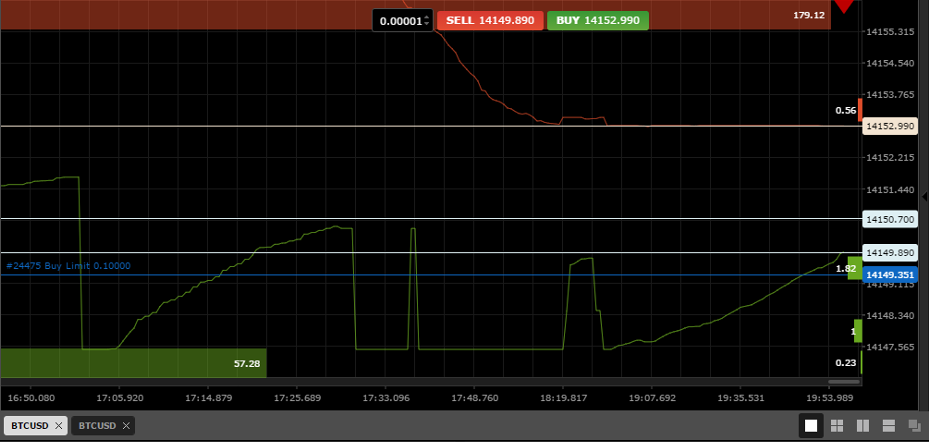

Let’s take a closer look at the buying process for this we’ll go over the tick chart. As you can see, the graph shows the offers to buy and to sell.

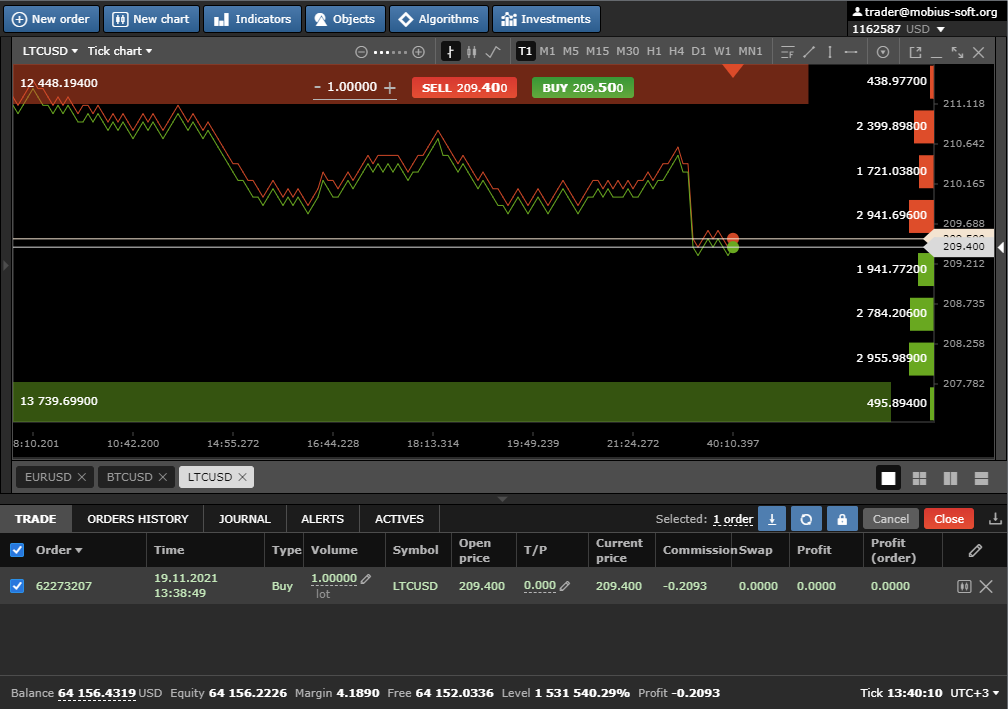

We can buy one light coin

Now we are closing deals with profit.

Thus, our balance increased by XXX because we bought cheaper and sold more (we earned on growth).

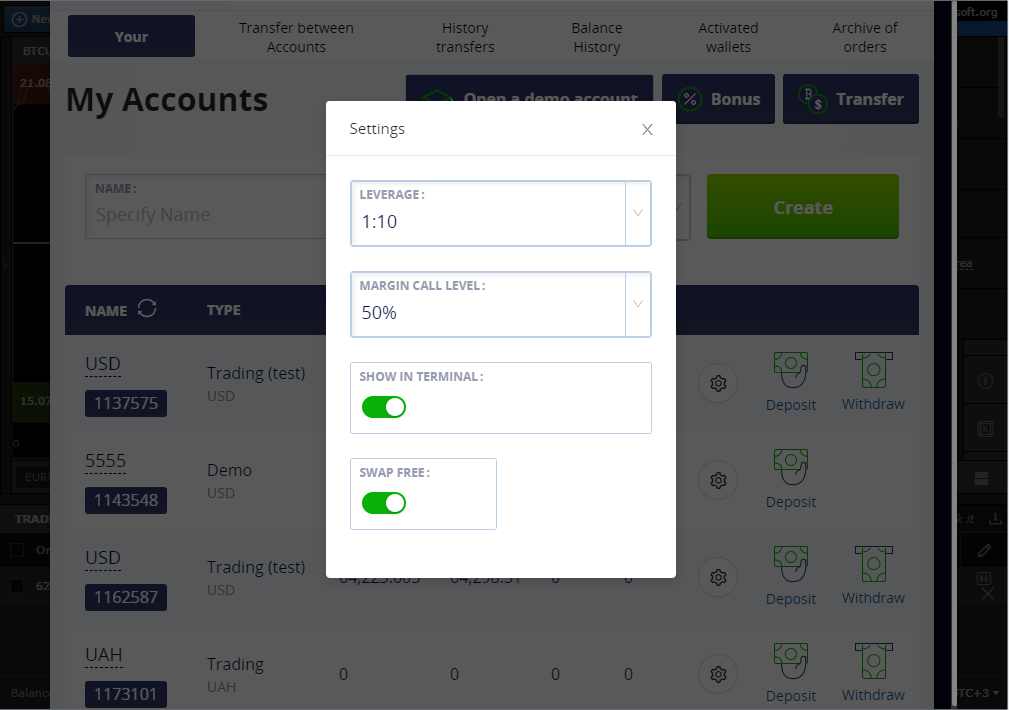

This happened at a leverage of 1: 1 (we did not use margin trading). What happens if we want to increase our profits? The exchange gives us such an opportunity. Set the Leverage 1: 10.

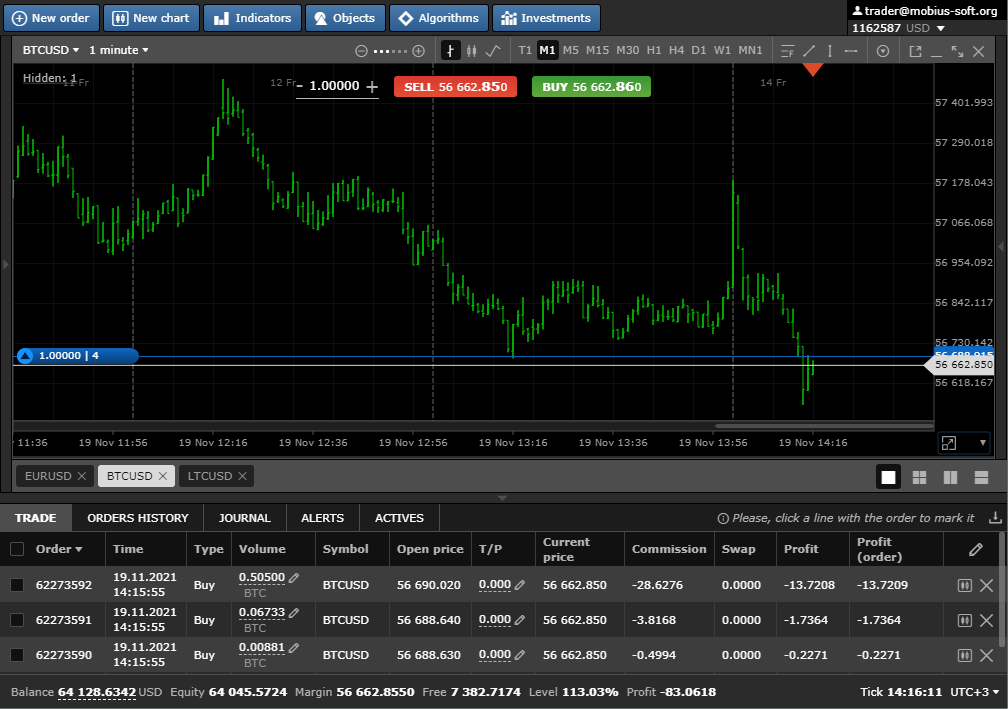

We go to the terminal and buy 1 more bitcoin.

As you can see, the deposit is 100 times less than the cost of one bitcoin. So we can buy another 3.

After a while, we close the deal and make a profit. It is 4 times more than we would get without margin trading.

Why is it an exchange? She receives her commission, which depends on the volume of transactions (since it was 4 times higher which means the exchange’s profit is 4 times higher).

As you have already noticed prices (a glass of prices) are compiled by all participants you can also change the glass by adding your bids to it.

Open a pending order.

We say that now the price is XXXXX, but we hope that the price will drop a little and we can buy more profitable. For example we hope that the price drops by 0.05-1% so we place a pending order at the price XXXX and wait.

As you can see now our order is visible in the glass of the exchange and is visible to all other participants.

After a few hours, we see that the price really fell, our order worked - here it is - and after that the price returned to its original position.

Russian

Russian  中文

中文  العربي

العربي  Bahasa Indonesia

Bahasa Indonesia