How to trade

In this part, I will give some tips how to make money when trading in cryptocurrency markets. Investing in bitcoins is a very risky thing at any time the price can drop to zero any cryptocurrency is threatened by a massive ban on governments or, more likely, a more perfect currency can be invented, which is simply more convenient to use.

Already, more than 100 cryptocurrencies are biting off pieces of the market from Bitcoin and from each other and there are more than a thousand cryptocurrencies in total. Tomorrow, any of them can improve its properties (say, the Lightning Network is activated) or atomic swaps can be introduced or vice versa states can prohibit any of them up to criminal liability (for example, prohibit zCash) a hole can be found in the wallet ( as happened with Bitcoin Gold) and so on. It is completely impossible to even approximately plan for several years or even months in advance which does not make it possible to invest adequately.

Another thing is trading on the exchange. A trader can earn both up and down any currency to any. You can earn on the growth of Bitcoin to the Dollar or on the fall. Or on the growth of bitcoin to lightcoin (even when both of them are cheaper against the dollar) and so on.

Traders truly have enormous opportunities to earn on any movement.

You can also earn not only on the move but also on the spread. You can simultaneously submit applications for the sale and purchase of bitcoin. For example, the following situation is currently on the exchange:

As you can see, the spread is about XXX% you can open pending buy and sell orders as follows.

Anyone who wants to buy or sell will buy from you. He will buy for XXX, and sell for IUU that is, in any case, you will win.

One of the easiest ways to earn money is to make money on the difference in the rates of various exchanges. Our exchange may have the following course,

and on the other at the same moment, another.

If you have money both there and there, then you can buy from us and sell it at another exchange. When leveling the course make a reverse transaction.

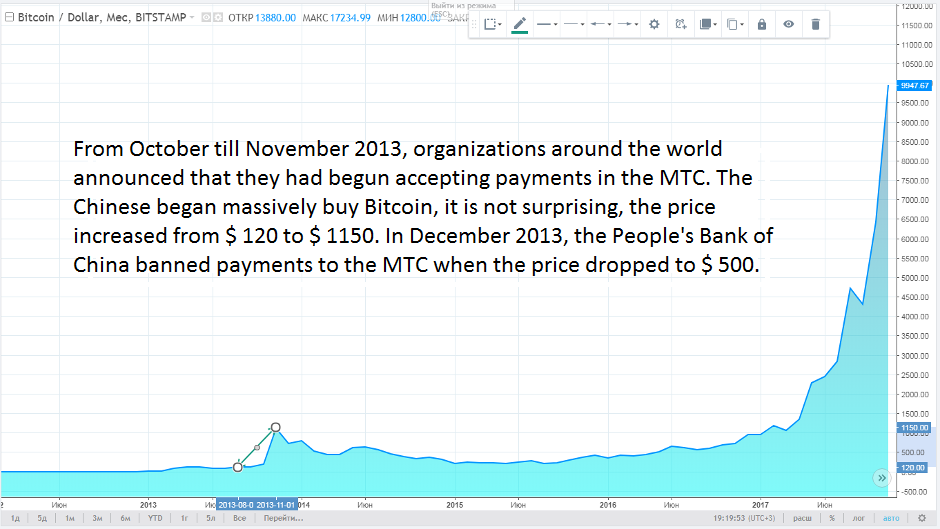

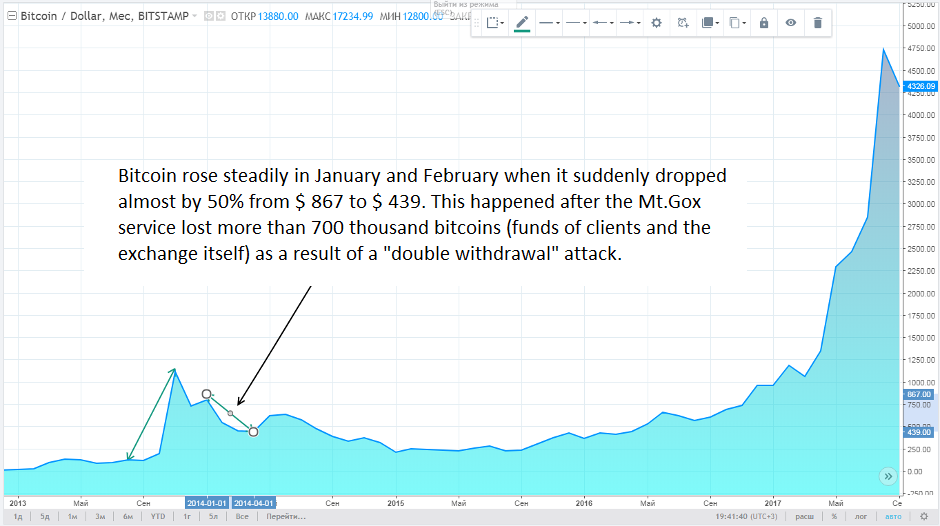

If you decide to become a trader the main thing you should do is to follow the news about cryptocurrencies. Any message can provoke a sharp rise or fall in the course.

The explosive driver for the December growth in the value of the main cryptocurrency was the news that the CME Group of Chicago exchanges is introducing bitcoin futures, which we wrote about earlier in our blog.

The second “explosion” occurred at a time when the competitors of CME Group, the Chicago-based CBOE operator, began trading bitcoin futures a week earlier on December 10. At the same time, CBOE decided to attract the maximum number of cryptocurrency traders and took another step, which testifies to fierce competition: it was announced that during the month the exchange will not charge a commission for XBT trades (designation of bitcoin futures). As a result, the expected explosive growth in the value of bitcoin occurred 8 days earlier, and one of the local peaks in the value of cryptocurrency in early December is associated with the upcoming start of trading.

Russian

Russian  中文

中文  العربي

العربي  Bahasa Indonesia

Bahasa Indonesia