Impulse strategy of Alexander Elder

The essence of the strategy is simple: we buy when the price grows, and we sell when the growth rate slows down.

Necessary condition of success is trading on the temporary interval where the average movement of the price on a trend makes not less than 10 spreads of your pair.

For euro it is 20 pips.

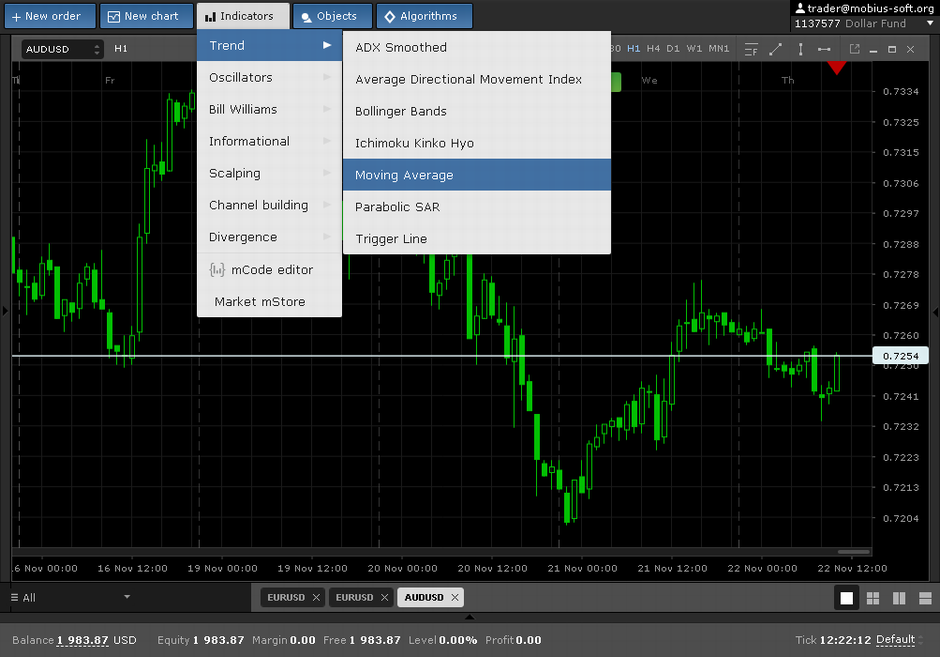

For trade by impuls system we need two indicators. Moving average and MACD. For installation of moving average it is necessary to click the button Indicators and in the appeared menu to choose Trend - Moving Average.

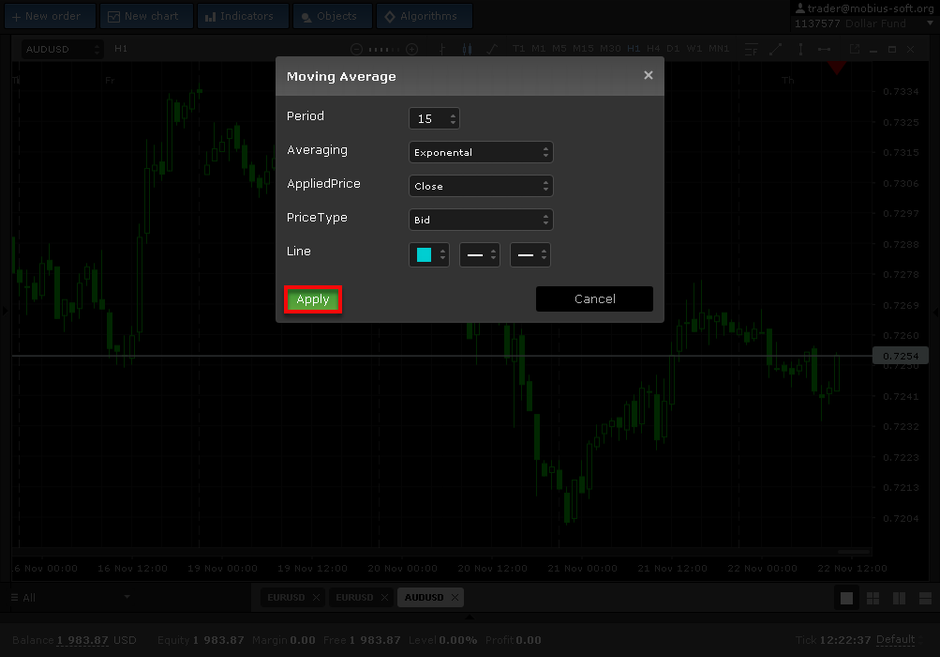

We specify Exponential Moving Average in settings and any, rather large period of averaging.

For installation of MACD Indicator on the chart, let's click the button Indicators at a toolbar and in the appeared menu choose Oscillators - MACD

The moving average measures the direction of a trend. When it is lower than the chart and raises, we consider that we have a bull trend.

If it is over the chart and falls, we have a bear trend.

The MACD indicator is used for assessment of speed of changes. The histogram MACD symbolizes about a good speed of growth if it is above the signal line. Respectively, MACD signals about the good speed of falling if the histogram is below the signal line.

If signals from average, and MACD Indicator match, we open the transaction.

Closing of transaction happens while one of indicators ceases to give a signal on buy.

In other words any "noise" which not necessarily speaks about change of a tendency can beat out you from the market.

Therefore this strategy will not allow you to take more than 15-20% of the Trend. Nevertheless, at the correct use it is reliable and rather unpretentious strategy. Certainly, on a flat this strategy will give all the same too many signals of an entrance and because of it can yield losses. Therefore Elder speaks about necessity of filtering of signals according to own strategy of three screens about which we spoke earlier. I.e. the entrance to the transaction is possible only after determination of the direction of a trend on longer timeframe.

The impulse system demands careful opening of positions and their fast closing. Such professional approach to exchange trade is the complete antithesis to style of amatures. Beginners open positions, without thinking twice, and infinitely postpone their closing in hope that the market will turn in their advantage. With the known result. It is also necessary to note that Alexander Elder's methods not only mechanical approach, and more likely a method of conducting of the stock exchange trading. You as if try to find order islands in the ocean of Chaos. Moments. when the crowd which is almost always behaves not orderly gets to the power of a powerful trend and all direct in one direction.

The impulse system demands the high level of self-discipline as it is difficult to give the order to the broker when the market already runs. It is even more difficult to close a position, without waiting for a trend turn when you are in a profitable position. Never abuse yourself for what was closed by transactions before the trend ended. Do not use this system if you have a lax discipline.

Russian

Russian  中文

中文  العربي

العربي  Bahasa Indonesia

Bahasa Indonesia