Basic Terms

Symbol (trading pair)

On the left in the trading terminal you see the Market Watch window. It displays symbols and two prices - the buy price and the sale price.

If you stretch it in width, you will also see the time of arrival of the last price. These are trading instruments or Symbols. Their buy price is Ask and their sale price is Bid. Move the mouse cursor to any of them, the graph opening icon will appear. Click on it the chart of this tool will open.

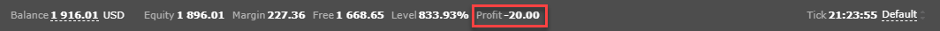

Trading account balance - the amount of funds that takes into account all balance sheet transactions and the result of all closed transactions. The balance of the trading account is updated with each closed position. Open transactions do not affect balance

Current profit

Current profit is the sum of all commissions, swaps and current profit for all open transactions.

Funds - an indicator that reflects the real situation on the trading account with open positions. Means = Balance + Profit. This indicator is more important than balance, because it reflects the current amount of funds.

If you do not have open positions Balance = Funds.

Leverage - the ability to open positions in a larger volume than a trader can afford. Provided by broker. It can be of different sizes. It is calculated in relation to the funds that the trader has on the balance sheet.

Suppose you invested $ 200 in an account and chose a leverage of 1: 100. In this case, your funds ($ 200) are multiplied by the leverage ($ 100) and you will be able to make trading operations worth $ 20,000. Unlike a regular loan, which you can take at a bank, you will not be able to manage the money provided by leverage. They do not appear on your balance sheet. They are used only when opening a position.

The trader gets the opportunity to trade in large amounts, and the broker receives more commission for transactions with large volumes.

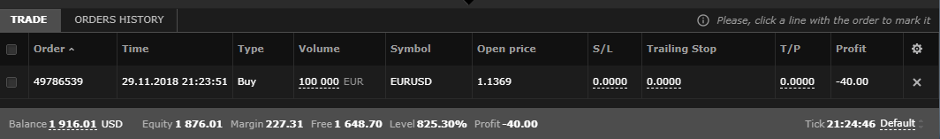

Collateral - the amount of funds required to open a position, taking into account leverage. This indicator is calculated quite simply. To do this, divide the amount of currency by the size of leverage.

Suppose a trader chooses a leverage of 1: 500 and is going to buy 100,000 EUR, while his balance is in dollars and he buys for USD.

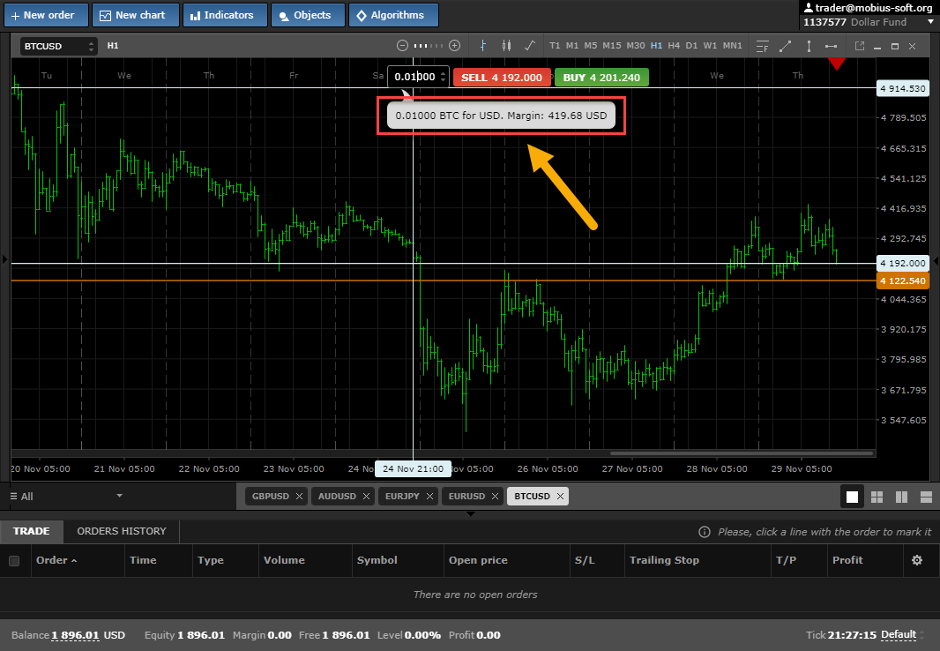

In this case, the security deposit is calculated as follows: 100,000 / 500 * EURUSD rate In the current case, it is equal to XXXXXXX. With a leverage of 1: 100, the deposit will be 5 times greater. Accordingly, in the absence of leverage your security deposit will be equal to the value of the goods. For example, when buying 0.01 bitcoin.

The deposit will be equal to XXX: which is equal to its current market value.

Available funds - the balance of funds on the trading account available for opening new positions. The amount of available funds may vary depending on the availability of open transactions.

Available funds = Funds - Collateral.

In the absence of open positions, available funds = funds = balance sheet

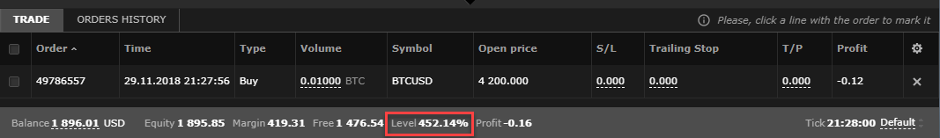

Level

This is the ratio of funds to collateral, expressed as a percentage. For example, if your deposit is 1000 and the funds are equal to 5000, your level will be 500%

Pips (pip) - an indicator of the minimum price change. Also known as “item”. Let's say the price of the euro-dollar has changed from 1.1600 to 1.1601. In this case, they say that the price increased by one pip (or pip, which is more correct, or a point). The word "pip" can be considered slang and very inaccurate. We do not recommend using it where accuracy is required since in some situations, 0.0001 of the price movement can be called a pip, in others 0.01, and sometimes 1

Russian

Russian  中文

中文  العربي

العربي  Bahasa Indonesia

Bahasa Indonesia