System for processing non-withdrawable (credit) funds

In the terminal mobius trader 7, a function of crediting a loan appeared immediately after the order was closed. A loan is company money that you can receive for your activity (trade), as well as a prize for a competition. A loan is no different from the balance sheet they also participate in drawdowns and trade. But it can not be deducted from the account. For trading, funds are used. Means = Balance + Credit + Current profit. Also, the loan will automatically nullify the negative balance upon entering the office, provided that there are no open orders.

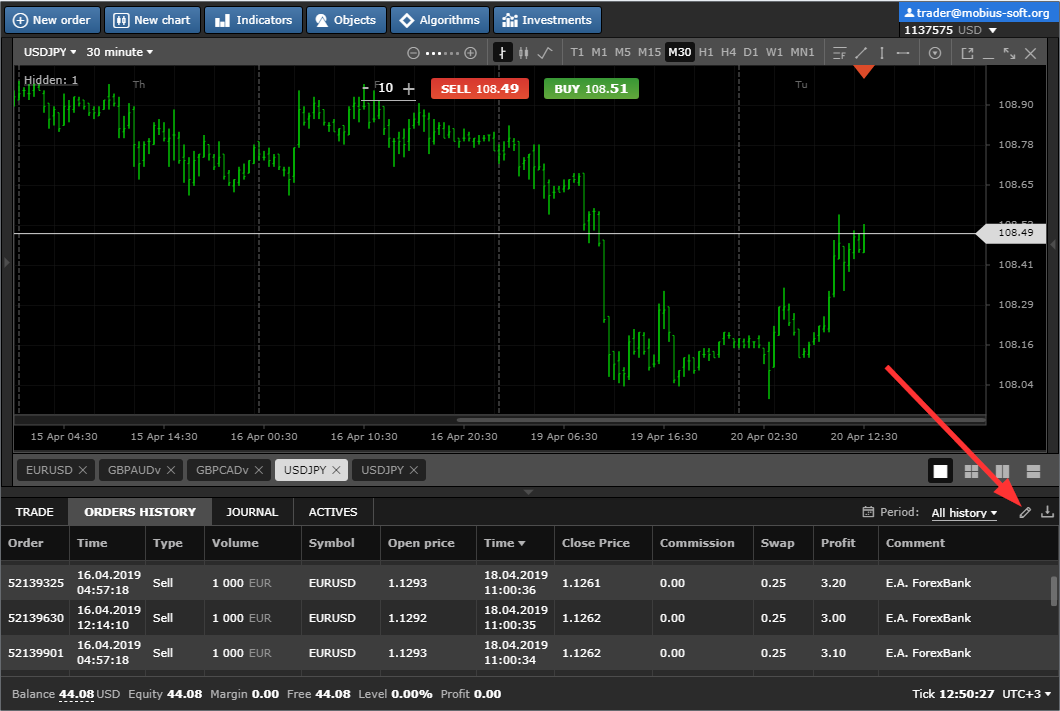

To display credit charges you need to click on the history settings button

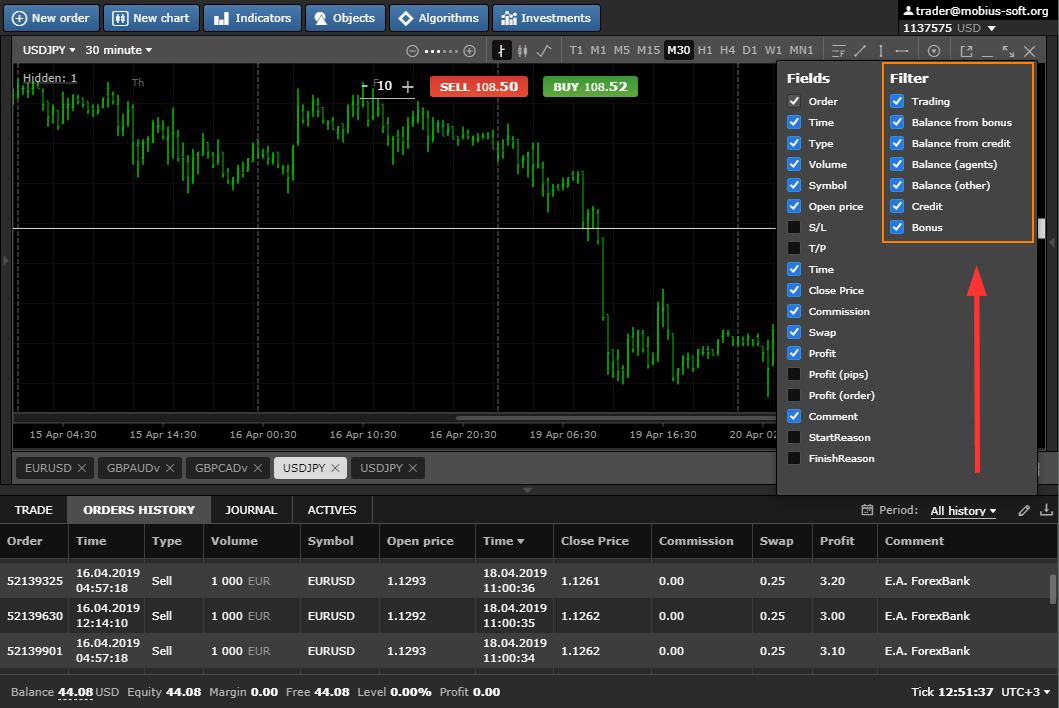

and check the boxes as shown in the picture below.

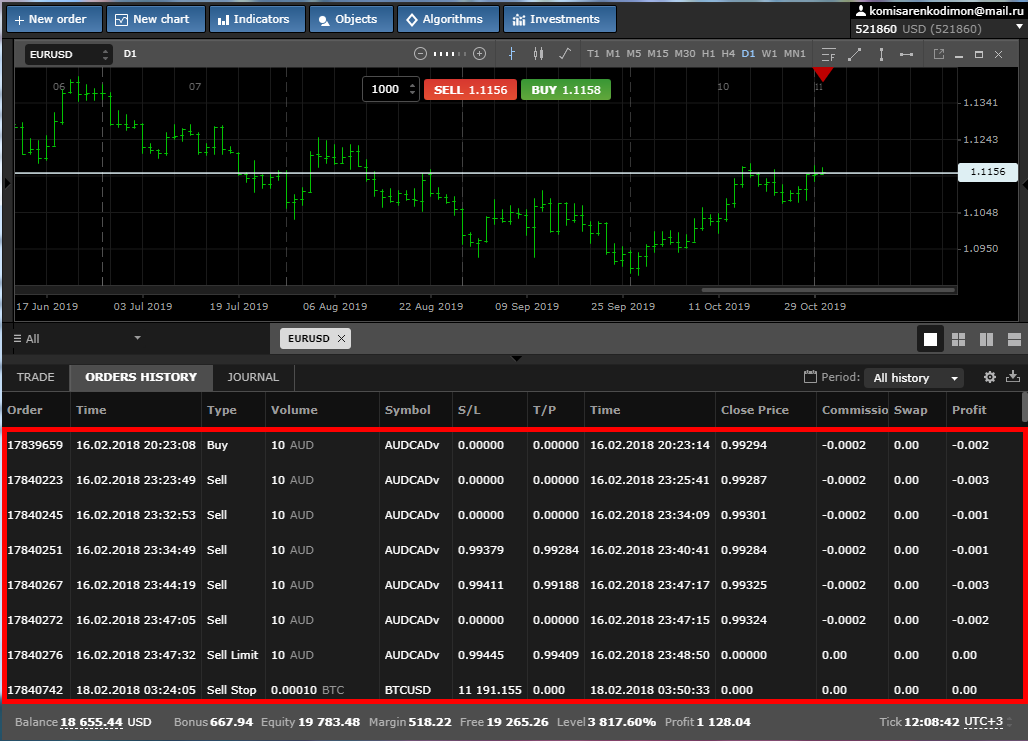

Note: Each broker may have its own percentage of credit payments. In the examples below, we just show how this scheme of payments works.

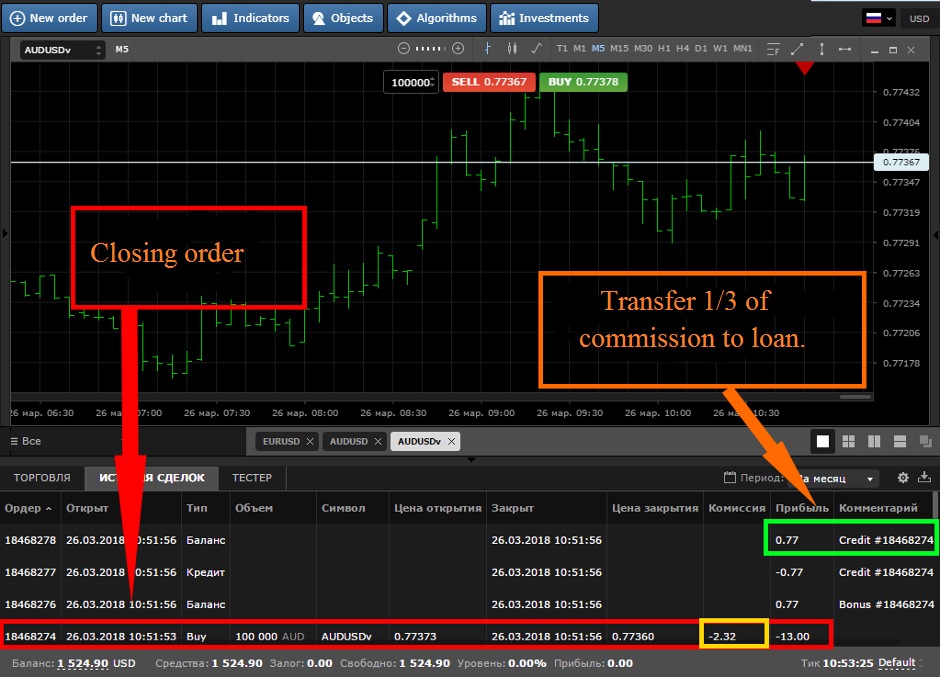

At a broker whose clients trade in the Mobius Trader 7 terminal, loan payments are calculated as follows:

For 100 000 professional volume of instruments with a fixed spread, you get 3 credits. In this example, we received 3 credits.

Trading instruments with the prefix V and ECN, as well as cryptocurrencies, you get 1/3 commission for the order. In the example below, we received 0.77 credits.

We want to note that if the display of loan payments does not give you the opportunity to analyze your trading history, you can turn it off at any time by removing the corresponding checkmarks, as shown in the figure below. In this case, accruals will still go. Just will not be displayed in the story.

Russian

Russian  中文

中文  العربي

العربي  Bahasa Indonesia

Bahasa Indonesia