Scalping - intraday - investment

Scalping, intraday or long-term investment?

In this section, we will consider one of the most important aspects on which the construction of the technical part of your trading system will directly depend.

To do this, answer a few questions. Namely:

how much time I am willing to devote to the trading process daily;

Do I want to get the final result on transactions open today at the end of my trading day;

Am I ready to transfer an open transaction before the start of the next trading day?

which is better, a small profit today and now, or the possibility of more profit tomorrow, but with the risk of not getting it at all;

Are you interested in an investment approach to trading?

From the answers to the above questions, you can understand which type of trade, based on the life expectancy of an open position, is best for you.

Let's move on to a brief presentation of the main types of trading strategies using the “time” classifier.

Scalping is a trade within one trading session on a minute chart. The time interval from the entry into the transaction and ending with the exit from it ranges from one minute and (usually) until the end of the current trading session (several hours). The exit mechanism (as a rule) is the achievement of either take profit or stop loss, unless manual or algorithmic (using a trading adviser) management of the transaction is provided. The distance from the trade entry level to the take profit level is (usually) from a few points to several tens (depending on the volatility of the instrument) points (a change of 0.1% -2% of the price). When scalping, special attention should be paid to the choice of exchange and trading conditions for the instrument. When entering and exiting directly through the market, execution speed, slippage and spread are crucial. It is also necessary to take into account the risks associated with capital management, as a rule, no more than 1% of the deposit amount is allocated to margin support for transactions within one business day (hereinafter, the default margin leverage is 1-100), and the recommended one is 0.1% per transaction . There can be several transactions within one business day. The trading algorithm for scalping should be very strictly formalized. This is due to the possible high transaction speed (from a second when throwing no news).

Graphic illustration

Green horizontal lines the maximum trading range during one incomplete trading session (the price has moved from the upper flat to the lower) the distance covered by the price is 71 points, the red vertical lines are the time.

Intraday holding a position open for one day. It can go through the swap the next day if the take level has not been reached and the chosen direction of trade corresponds to the trading plan. The position structure can be either simple (one order) or composite (several orders) with various intermediate levels of profit taking. The distance from the level of opening a position to the level of maximum take profit can be from several tens to possibly hundreds of points (on volatile assets such as bitcoin). Using a deposit to secure collateral requirements can range from 1 to 5% (recommended) depending on the aggressiveness of the trading strategy and money management. The analysis for making a decision on entry is performed on the chart Н4 and Н1, the entry and tracking of the position on the chart М15 and М5. The decision to open the position contains elements of fundamental analysis and the structure of economic news for the entire time interval until its scheduled closing. Often, the trader receives the main signals for opening / closing a position from indicators. When calculating entry levels - take - stop loss levels, it is recommended to pay special attention to support and resistance levels within the current trend at the oldest of the analyzed time intervals.

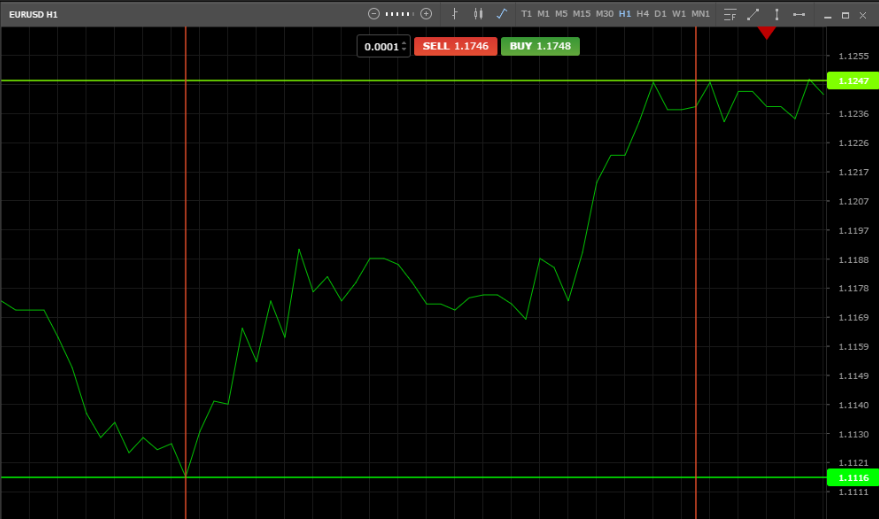

Graphic illustration

Green horizontal lines the maximum trading range for two trading days 131 points (the trend was upward, with a flat zone), where the red vertical lines are time.

The investment approach to trade (medium and long-term strategy) is the most difficult type of trade from the point of view of analysis and planning. The time spent in the position from several days to several weeks, working off the distance hundreds and thousands of points (up to 10% of the price change). Trend trading and correction correction, full-fledged fundamental analysis, a combination of trend and flat phases of trading. Patterns, waves, levels, inclined and horizontal channels. The most developed risk management, which includes a set of initial position (2-5% recommended) with its subsequent growth according to the trend, the ability to combine long-term and medium-term trading while working out horizontal flat in the consolidation phase. The most complex trading strategy from a psychological point of view, requiring a long exposure based on knowledge and experience.

Graphic illustration

Green horizontal lines - the maximum trading range during the quarter - 696 points (the trend was upward, but included a phase of deep correction), where the red vertical lines are time.

Each of the strategies briefly described above has its advantages and disadvantages. It is up to the trader to decide which one to choose. After making this decision, you can begin to create your own trading system, sequentially connecting risk management and elements of psychology.

Russian

Russian  中文

中文  العربي

العربي  Bahasa Indonesia

Bahasa Indonesia