US national debt

Why we decided to highlight this topic in a separate chapter. Because the fact is that the world has developed an economy when all world values are valued in dollars. When we say "Apple Stocks" have risen in price we mean they began to cost more than dollars. The same thing when we say “Oil has risen in price” or “Bitcoin has risen in price” we are talking about the fact that it has begun to cost in dollars.

It is within the framework of this paradigm that we say “the euro is falling” or “the ruble is growing”. Therefore, a possible collapse (or fall) of the dollar can provoke a completely unpredictable reaction to all markets. And the main factor that can affect the dollar is the US national debt, the maintenance of which requires the constant release of new dollars.

The US national debt, like any other state debt, is a state borrowing from private and legal entities, as well as other states. In mid-2017, America’s total debt amounted to almost 20 trillion. dollars in absolute terms or 104% of GDP.

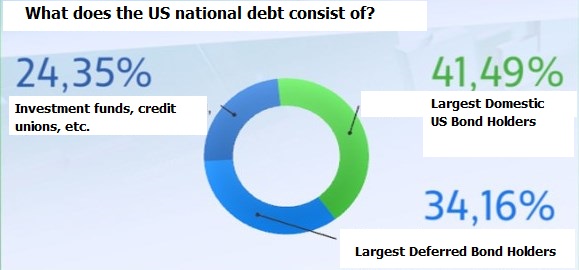

Structure

In its structure, the US public debt can be divided into two main parts:

- inside

- public part

The inside is debt to government agencies and pension funds. This is more like a form of mutual settlement of the state with state institutions and officials. This part of the debt is denominated in treasury bonds.

The public part is other creditors, including individuals and legal entities, funds, other states.

Securities

Government borrowing in the United States is carried out through the following securities with a fixed yield:

Treasury bill is the term of such a paper is one year, after which the income is paid, as well as the body of the debt.

Treasury Note the term for the performance of such an obligation is from one year to ten years. The face value of such a paper is from one thousand to a million dollars. Income is paid every six months.

Treasury bonds (T-Bond) - they are issued for a period of ten to thirty years. Income is paid every six months. This is the most common type of paper.

Treasury Inflation Protected Securities (TIPS) these securities are issued in denominations of one hundred dollars for periods of five, ten and twenty years. The peculiarity of this bond is that its nominal value is indexed in accordance with inflation, with a fixed yield that is paid every six months.

Market price

The US government debt securities are freely traded on the stock market, where the market value is formed, based on which, the yield at the time of trading is calculated.

Profitability

An example of the yield on US government securities on 11/06/17,% per year:

1-month 0.779

3 month 1,011

6 month 1,124

1 year old 1,194

2 year old 1,343

3 year old 1,489

5 year old 1,775

7 year old 2,019

10 year old 2,211

30 year old 2.865

The table shows the longer the borrowing period, the higher the yield.

Market impact

US government debt is a low-risk asset, but it does not have a very high yield. Investors use public debt as a "safe haven" for their funds in turbulent times in the global economy. Thus, the yield on US government bonds is a certain confidence index. When the confidence of market participants is high, they increase the share of risky assets in their portfolios, getting rid of bonds, the cost of bonds falls, and their yield increases. Also, with an increase in profitability, the following processes can occur: the growth of the S&P 500 wide market index, the strengthening of the American currency, the value of protective assets such as gold and the Japanese yen falls, the value of real estate and consumer goods decreases, and shares in the financial sector can also be observed.

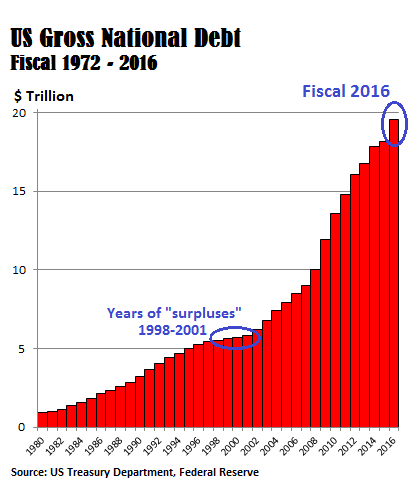

Overview of the current situation

At the end of September 2016, the brightest fiscal year in the United States ended. Allocates him from all the others an unprecedented growth of the country's national debt by 1.4 trillion dollars. Also summing up, we can say that in less than a decade the public debt has doubled, i.e. as well as for two hundred years of the country's history. The growth rate is horrific, it was not like during the Second World War, when Europe needed to borrow 12 billion dollars or 4.3% of GDP to recover Europe, or in the midst of the 2009 mortgage crisis, the necessary support for the banking system amounted to 700 billion dollars or 5% of GDP USA. Now, judging by the growth rate of borrowings, it seems that in 2016 there were all wars, crises and cataclysms at the same time.

The growth rate is causing investors around the world to be cautious, since in the event of a US default, collapse can happen in the entire global economy. To add optimism to this gloomy scenario, it is fashionable to say that, purely technically, the United States can repay a public debt at any time, simply by printing how many dollars are needed. Of course, this will lead to inflation and the depreciation of the currency, but at least this is a guarantee that there will be no sudden default.

The most important thing is not the threat of default itself, and it is clear that it is unlikely to happen in the near future. More acute interest is now causing the US ability to service the public debt in full. But judging by macroeconomic indicators, now the country's economy is on the rise, and while GDP growth rates exceed obligations on government securities yields, there is no need to fear.

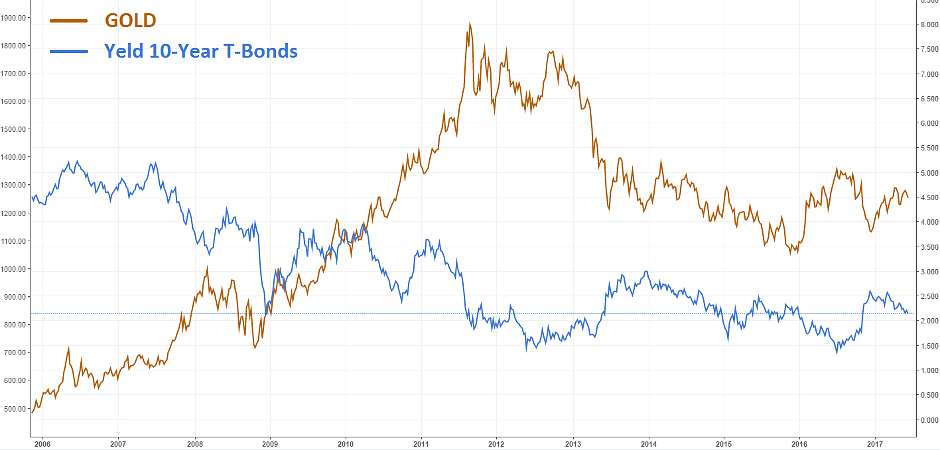

Gold and T-Bonds

Like gold, government treasury bonds are protective assets that investors use to reduce risks in difficult times when different market disasters are expected or are observed due to geopolitical or economic events. Therefore, an increase in demand for both assets arises approximately at the same time, consequently, when the price of gold rises, the value of government bonds also rises and their profitability falls after it. It turns out that the value of gold is inversely correlated with the yield of government debt securities. A similar picture can be observed on the charts of instruments over the past 10 years:

You may notice that the reverse correlation is mainly observed, but there are areas where the yields of T-Bonds and gold go in parallel. The main difference between these instruments is that government bonds have paid income, but gold does not, and it can only be profitable due to the difference in the purchase and sale prices. Therefore, depending on additional external factors, investors may prefer one asset to another. For example, with increasing geopolitical risks or the growth rate of gold, this asset looks more attractive than government bonds.

Russian

Russian  中文

中文  العربي

العربي  Bahasa Indonesia

Bahasa Indonesia