Trading Sessions. What you need to know about the time of bidding. Time shift in terminals. Weekend in the market.

This is a separate chapter on the Forex market, however, the general idea of trading sessions can be applied on stock and even cryptocurrency exchanges. Typically, the working day is eight hours. But this rule does not apply to markets. It works 24 hours without a break. Cryptocurrencies are traded non-stop, 24/7. The Forex market does not trade on the weekend. The operation of other markets depends on the exchanges.

Nevertheless, the activity of traders in a particular country depends on the working day and is determined by when it is convenient to work. Accordingly, if there is a day in Japan at the moment, then trading on the Tokyo Stock Exchange, in the Yen currency and in those cryptocurrencies that are interesting to Japanese traders will actively go on. And when the day comes in America, there will be activity on other instruments. It is important to know this when trading and adjust your own trading approach depending on the activity of various financial instruments.

Bidding begins the Asia-Pacific region, whose main trading floors are in Wellington (New Zealand), Sydney (Australia), Tokyo (Japan), Hong Kong and Shanghai (China) and Singapore. Then traders of Europe, whose main exchanges are located in German Frankfurt, Swiss Zurich and the British capital - London, start trading. The time of European trade is not yet over when the exchange centers of the American continent join them. Toronto Canada and American Chicago and New York. This overlap in time accounts for the bulk of the operations. The shift in working time between exchanges is due to different time zones. These factors must be taken into account when choosing trading instruments, since in addition to instruments that are traded on all platforms, there are also regional ones. Trading volumes and volatility also differ. Asian sessions are more relaxed compared to volatile American ones, and European trading becomes more aggressive after the opening of London.

The main currencies for Asian traders are the Japanese yen paired with the US dollar and Euro, as well as the Australian dollar (referred to as kiwi on the trader slang) against the American one. In European trading, it is EUR, Swiss franc and British pound against the US dollar. America trades all instruments for the dollar. If we talk about the cryptocurrency market, then the Americans especially prefer Ethereum and do not trade in HEM and NEO, and the Chinese on the contrary.

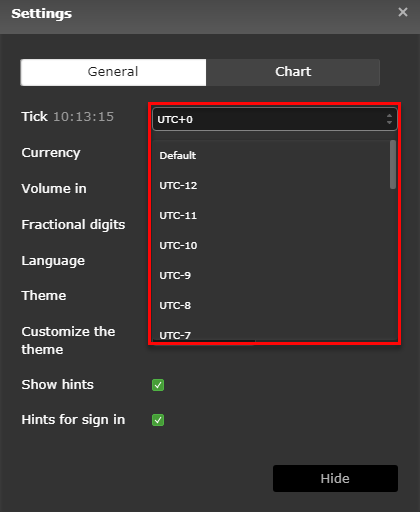

For the convenience of traders, the trading terminal provides the ability to change the time in case of a change of time zone.

Example of a time change in MT7 (Mobius):

Russian

Russian  中文

中文  العربي

العربي  Bahasa Indonesia

Bahasa Indonesia